Applicable Industries

- Consumer Goods

- Retail

Applicable Functions

- Quality Assurance

- Sales & Marketing

Use Cases

- Machine to Machine Payments

About The Customer

MasterCard is a leading technology company in the global payments industry and the second largest processor in the world. It operates the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments, and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business, and managing finances – easier, more secure, and more efficient for everyone. The company is continuously growing with rapidly expanding product offerings.

The Challenge

MasterCard, a global technology company in the payments industry, was facing a significant challenge in its business financial support team. The team of 13 was spending between 40 to 80 hours per week manually reconciling transactions and cash from reports that resided on the company’s mainframe. This process involved printing 20-30 individual, multi-page reports daily and hand-keying data into Excel for reconciliation. The task was not only time-consuming but also inefficient, especially considering the company's rapid growth and expanding product offerings. Derek Madison, Leader of Business Financial Support at MasterCard, was tasked with identifying new ways to increase efficiency and improve MasterCard processes.

The Solution

MasterCard adopted a data preparation solution from Monarch to address this challenge. Monarch extracts vital information locked in mainframe reports and delivers it to a team of analysts for immediate use. Madison and his team created reusable data prep models with Altair® Monarch®, which allowed them to convert the needed mainframe files into a tabular data file ready for analysis. Specific dates and times were recorded on mainframe reports, and a program was created to rename the output files and save them to a location that corresponded with the date. This automation eliminated the time-intensive manual hand keying, enabling the team to shift their resources to higher value and more strategic goals.

Operational Impact

Quantitative Benefit

Case Study missing?

Start adding your own!

Register with your work email and create a new case study profile for your business.

Related Case Studies.

.png)

Case Study

Improving Vending Machine Profitability with the Internet of Things (IoT)

The vending industry is undergoing a sea change, taking advantage of new technologies to go beyond just delivering snacks to creating a new retail location. Intelligent vending machines can be found in many public locations as well as company facilities, selling different types of goods and services, including even computer accessories, gold bars, tickets, and office supplies. With increasing sophistication, they may also provide time- and location-based data pertaining to sales, inventory, and customer preferences. But at the end of the day, vending machine operators know greater profitability is driven by higher sales and lower operating costs.

Case Study

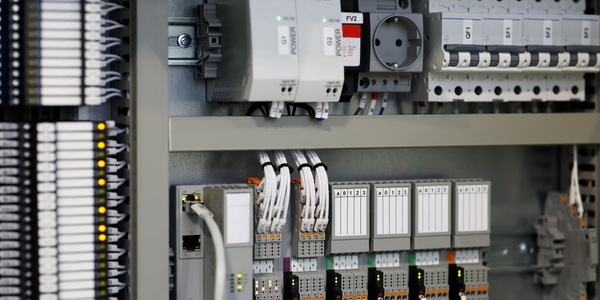

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.