技术

- 应用基础设施与中间件 - 数据库管理和存储

- 基础设施即服务 (IaaS) - 云数据库

用例

- 租赁金融自动化

关于客户

任仕达是人力资源服务行业的全球领导者,专注于灵活工作和人力资源服务领域的解决方案。他们的服务范围从常规临时人员配置和永久安置到内部、专业人员和人力资源解决方案。任仕达的人才数据库是其为聪明的个人提供优质工作机会的使命的重要组成部分。然而,他们在维持该数据库的最新性和大规模培养关系方面面临挑战,特别是随着新隐私法的出现以及在紧张的劳动力市场中发现新求职者的需要。

挑战

任仕达是一家全球领先的人才招聘机构,在保持人才数据库的最新性和大规模培养关系方面面临着重大挑战。该公司的使命是将聪明的人与优秀的工作相匹配,而他们的人才数据库是这一使命的核心组成部分。然而,由于新的隐私法要求明确同意,该公司正在努力有效地吸引数百万候选人并保持国内合规性。此外,他们还面临着在紧张的劳动力市场中寻找新求职者的挑战。使用登陆页面和表单字段来收集个人资料详细信息的传统营销自动化方法并未产生预期的结果。

解决方案

为了克服这些挑战,任仕达求助于 AI 解决方案提供商 AllyO。 AllyO 提供了一种现代且可扩展的方式来吸引候选人,将电子邮件外展与基于自然语言的多语言网络聊天相结合。这种方法旨在支持英语和法语的多语言交流,并大规模吸引数百万候选人。该解决方案还旨在发现新的求职者并丰富候选人资料,以维持国内合规性。该解决方案的实施非常迅速,只用了不到四个星期的时间。 AllyO 的解决方案能够在短时间内联系超过 160 万个人资料并发现 12,500 名新的活跃求职者。

运营影响

数量效益

Case Study missing?

Start adding your own!

Register with your work email and create a new case study profile for your business.

相关案例.

Case Study

Digital Transformation in Insurance: A Case Study of Menora Mivtachim

Menora Mivtachim, one of Israel's largest pension fund and insurance carriers, was facing a significant challenge due to demographic trends in Israel. The growing rate of retirement planning and services was putting unprecedented pressure on the already strained insurance sector. The pension claims process was bottlenecked with complexities, bureaucracy, and errors. Menora Mivtachim's existing pension process was heavily manual and spreadsheet-based, requiring a team of 10 full-time employees to manage. The process involved gathering applicant information, conducting personal surveys, compiling bank information, and finalizing agreements. To leverage the growing opportunity in the retirement sector and position themselves as innovative insurtech leaders, Menora Mivtachim needed to digitalize their process, streamline the claims experience, and reduce quote times through automated processes.

Case Study

Automation in Mining: Unleashing Productivity and Efficiency with 5G

The mining industry, a significant contributor to global economic activity with revenues exceeding USD 500 billion, is facing a challenge of improving efficiency and profitability. The industry is gradually shifting its focus towards automation as the next area of opportunity. Boliden, one of the world's most successful mining companies, operates the Aitik mine, the largest open pit in Europe. The Aitik mine is expanding, and with the increase in production from 36 million metric tons of ore to 45 million metric tons, the amount of rock removed will also increase significantly. However, increasing the number of machines required for rock removal in a busy mine is not a straightforward task. Additionally, every blast creates toxic gases that need to dissipate before humans can enter the area and begin excavation. The challenge lies in improving efficiency, managing the increased production, and ensuring safety in the harsh mining environment.

Case Study

ANZ Bank's Digital Transformation with Nintex Advanced Workflow

ANZ Bank, one of the top 50 banks in the world and the fastest-growing bank in Indonesia, was facing a challenge with its rapidly increasing transaction volume. The bank's existing business processes and workflow were becoming overwhelmed. Like most banks in Indonesia, ANZ was manually handling document submission and verification. Customers filled out paper loan applications and supporting documents, then delivered them to bank branches by mail or courier. Branch officers traveled to the bank’s headquarters or used postal mail, email, and phone calls to submit loan documents for verification. Lost or inaccurate documents created more emails and phone calls. Additionally, ANZ had to adhere to strict verification and financial regulations, including the Foreign Accounts Compliance Act. This act requires that all banks outside the United States provide key information about U.S. clients, including citizenship validation, to the Internal Revenue Service–a complex yet crucial process.

Case Study

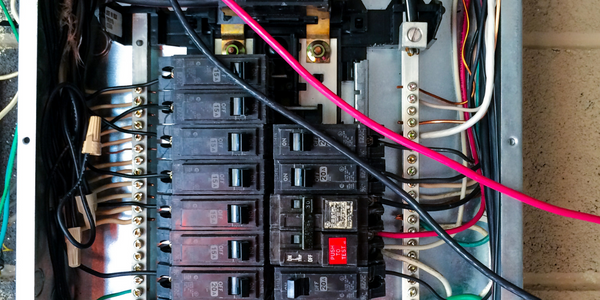

Streamlining Agricultural Automation with Eaton’s Package Solution

Grossi Electric, a full-service electrical contracting company, was tasked with facilitating the hulling, dehydrating, and preparation processes at a walnut processing plant in Waterford, California. The company aimed to explore innovative options for creating cleaner and more efficient control panels that would eliminate the intensive time, labor, and costs associated with excessive point-to-point wiring. As a rapidly growing electrical contracting company, Grossi Electric was also concerned about managing risk and cost while attempting to establish a new and unfamiliar service offering in a mature market for control products. The walnut processing plant presented a prime learning opportunity for the company to discover the best way to build more tailored control panels for its customers. The challenge was to enable a lean automation process that was smarter, simpler, more effective, and of unique advantage for clients.

Case Study

Dell's Transformation: Boosting HR Productivity with RPA and Workday

Dell Technologies, a global tech giant with over 160,000 employees, was grappling with high-volume and repetitive transactional HR processes. The company was seeking to improve efficiency and cost-effectiveness while freeing up HR employees for higher-value, strategic work. The challenge was to eliminate transactional work for end-to-end processes such as open requisition recruiter assignments, onboarding process reminders and status updates, and offer status management. This would allow HR employees to focus more on person-to-person interactions.

Case Study

Advancing RPA Initiatives in Financial Reporting: A Case Study of a Global Bank

The global bank, based out of North America, was facing a significant challenge in managing its report repository connected to dozens of applications and database systems used across the enterprise. The bank, serving close to 20 million customers worldwide, had to manually download hundreds of thousands of reports from these applications to a centralized location for use on a weekly basis. The file formats were typically unstructured data, usually in text or PDF, with no consistency in report formats across the different applications, or even for reports created using the same application. End users would then manually copy data from the text / PDF formats to Excel-based reports used for reconciliation, attestation, financial reporting, journal entries and other uses. This process was time-consuming, prone to human error, and inefficient.