- Platform as a Service (PaaS) - Application Development Platforms

- Finance & Insurance

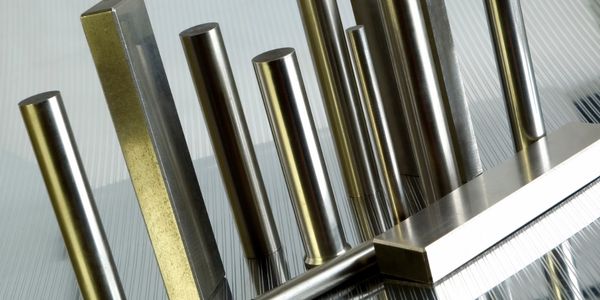

- Metals

- Logistics & Transportation

- Procurement

- Continuous Emission Monitoring Systems

- Leasing Finance Automation

- System Integration

Rabobank is a cooperative bank with almost ninety local Rabobanks in the Netherlands, each operating with a high degree of independence to better serve their customers and local communities. Rabobank also has sizeable international banking operations. The Trade and Commodity Finance business unit of Rabobank combines the bank’s long-term expertise in agricultural commodities, energy, and metals finance. Rabobank is committed to taking action on its financed emissions and carbon risks and has been working with clients to address high-emitting supply chains in its commodity trade finance portfolio since 2020.

Rabobank, a cooperative bank with a significant international banking operation, is committed to addressing its financed emissions and carbon risks. Since 2020, the bank has been working with clients to address high-emitting supply chains in its commodity trade finance portfolio. For instance, Rabobank implemented a pilot scheme offering metal commodity traders incentives for meeting sustainability targets and a template for clients to develop a climate action plan to decarbonize their trade flows. However, Rabobank faced a significant challenge: the lack of high-quality emissions data for clients’ supply chains. The bank recognized that to strengthen its green finance schemes and set quantified targets with measurable progress, it needed to overcome this barrier. Rabobank aimed to achieve three key goals: setting emissions reduction targets, advising clients on carbon risk reduction, and reducing the carbon footprint of its trade commodity finance portfolio.

Rabobank collaborated with traders and used CarbonChain’s carbon accounting software to accelerate action towards its goals. The bank is running a pilot for carbon intensity supply chain data collection using CarbonChain’s platform, which is linked with the Rabo Trace portal. This integration allows Rabobank’s clients to easily extract and share raw data. CarbonChain’s AI-powered technology then quickly and automatically calculates each trade’s overall carbon footprint and carbon intensity, across the entire supply chain, alongside granular breakdowns. This enables both financier and trader to identify key carbon hotspots and opportunities for emissions reductions. CarbonChain also calculated the emissions of a sample of the copper and aluminum trades of one of Rabobank’s key trade finance clients, Concord Resources Limited, producing a comprehensive carbon footprint and intensity report, with actionable insights. Rabobank ensured that their carbon accounting aligned with global carbon reporting standards such as the GHG Protocol and CDP disclosure.

Case Study missing?

Start adding your own!

Register with your work email and create a new case study profile for your business.

Related Case Studies.