97% Hit Rate with Automation: Martin Marietta’s Story

Customer Company Size

Large Corporate

Region

- America

Country

- United States

Product

- Cash Application Cloud

- Credit Cloud

Tech Stack

- Artificial Intelligence

- ERP Integration

- Dashboards

Implementation Scale

- Enterprise-wide Deployment

Impact Metrics

- Cost Savings

- Productivity Improvements

- Customer Satisfaction

Technology Category

- Analytics & Modeling - Predictive Analytics

- Functional Applications - Enterprise Resource Planning Systems (ERP)

- Application Infrastructure & Middleware - Data Exchange & Integration

Applicable Industries

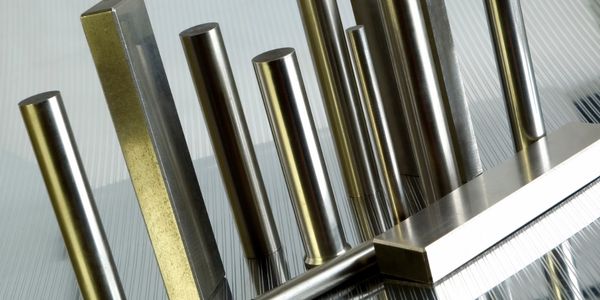

- Metals

- Mining

Applicable Functions

- Business Operation

- Quality Assurance

Use Cases

- Process Control & Optimization

Services

- Software Design & Engineering Services

- System Integration

- Cloud Planning, Design & Implementation Services

About The Customer

Martin Marietta is a leading supplier of aggregates and heavy building materials, based in the United States. The company operates a vast network spanning 27 states and over 400 operations, including locations in Canada and the Bahamas. Established as a major player in the metals and mining industry, Martin Marietta has a strong focus on integrating acquisitions and maintaining a vision of becoming a world-class organization. In 2015, they set up a shared service center to centralize their operations, particularly in the areas of credit and collections, cash application, and credit references. The company sought to standardize processes, improve efficiency, and reduce operational expenditures, all while increasing visibility and configurability in their systems.

The Challenge

An industrial giant in metals and mining, Martin Marietta faced significant challenges in its operations overall. The processes they had in place, such as keying in information, were highly manual and took up a lot of the analysts’ time. The company needed a way to repurpose this effort into more productive tasks like analysis and value optimization. Processes also lacked standardization which needed to be addressed and they wanted a method to increase visibility into metrics to help track where time was being wasted. They were using three lockboxes and 1 EDI file along with bank keying in.\n\nCredit\n\nDecentralized Processes\nEach division followed its own processes and this led to confusion among teams. It also led to inconsistencies in information gathering for shared customers.\n\nManual Work\nProcesses were completely manual based on forms that needed to be filled in by credit managers from the master data. Record-Keeping was exclusively hands-on and analysts also made customer calls and set-ups in person, which took up a lot of time.\n\nLack of Visibility\nGetting audits done for credit analysis was a huge task because the information was inaccurate. A lack of transparency also caused inconsistencies in credit calculations.\n\nCash Application\n\nMis-Keying of Information\nInformation wasn't being accurately fed into the system by banks, causing frustration and misapplication on the analysts’ side. This called unnecessary delays and errors.\n\nNon-Standardized Practices\nCustomers paid with inconsistent formats like tickets and statements that caused issues because information regarding invoices and remittance had to be aggregated manually from these documents. This consumed a lot of the analysts’ bandwidth so identification of payments also became a hectic task.

The Solution

Martin Marietta collaborated with HighRadius to address their operational challenges. HighRadius provided two key solutions: Credit Cloud and Cash Application Cloud.\n\nCredit Cloud\n\nLogging Tasks & Follow-Up\nDetailed tracking of correspondence history and follow-ups helped create a streamlined process that increased transparency and a smoother workflow.\n\nStandardized Processes\nThe solution brought standardization into their operations with the help of configurable scoring models and workflows. It also automatically extracted credit data and made accurate predictions on customers’ payments.\n\nIncreased Visibility and Tracking\nThe use of dashboards and worklists allowed analysts and execs to access KPIs and track team productivity easily. The solution also helped give them a better understanding of which customers were higher risk, and helped set credit limits.\n\nCash Application Cloud\n\nAuto-Aggregation of Remittance Information\nThe solution was able to automatically pull data from the different remittance sources and formats they received. This feature helped them tackle the issue of inconsistent payment formats and was able to automate data extraction. It also saved time and helped increase accuracy by keeping errors to a minimum.\n\nImproved Efficiency\nThe solution helped Martin Marietta boost productivity by reallocating analysts and automating their workload. This ensured that analysts could be shifted to higher priority tasks instead.\n\nEasy ERP Integration\nThe solution could easily integrate with different ERPs and made it easier to carry out data migration and reduce time wasted on tech support. It was also scalable and had the capacity to accommodate improvements.

Operational Impact

Quantitative Benefit

Case Study missing?

Start adding your own!

Register with your work email and create a new case study profile for your business.

Related Case Studies.

Case Study

Goldcorp: Internet of Things Enables the Mine of the Future

Goldcorp is committed to responsible mining practices and maintaining maximum safety for its workers. At the same time, the firm is constantly exploring ways to improve the efficiency of its operations, extend the life of its assets, and control costs. Goldcorp needed technology that can maximize production efficiency by tracking all mining operations, keep employees safe with remote operations and monitoring of hazardous work areas and control production costs through better asset and site management.

Case Study

KSP Steel Decentralized Control Room

While on-site in Pavlodar, Kazakhstan, the DAQRI team of Business Development and Solutions Architecture personnel worked closely with KSP Steel’s production leadership to understand the steel production process, operational challenges, and worker pain points.

Case Study

Bluescope Steel on Path to Digitally Transform Operations and IT

Increasing competition and fluctuations in the construction market prompted BlueScope Steel to look toward digital transformation of its four businesses, including modern core applications and IT infrastructure. BlueScope needed to modernize its infrastructure and adopt new technologies to improve operations and supply chain efficiency while maintaining and updating an aging application portfolio.

Case Study

RobotStudio Case Study: Benteler Automobiltechnik

Benteler has a small pipe business area for which they produce fuel lines and coolant lines made of aluminum for Porsche and other car manufacturers. One of the problems in production was that when Benteler added new products, production had too much downtime.

Case Study

Continuous Casting Machines in a Steel Factory

With a very broad range of applications, steel is an important material and has been developed into the most extensive alloy in the engineering world. Since delivering high quality is absolutely crucial for steel plants, ensuring maximum productivity and the best quality production are the keys to competitiveness in the steel industry. Additionally, working conditions in steel factories are not suitable for workers to stay in for long periods of time, so manufactures usually adopt various machines to complete the steel production processes. However, the precision of these machines is often overestimated and the lack of flexibility also makes supervisors unable to adjust operating procedures. A renowned steel factory in Asia planned to improve its Distributed Control System (DCS) of furnaces as well as addressing the problem of insufficient accuracy. However, most well-known international equipment suppliers can not provide a satisfactory solution and local maintenance because the project needed new technologies to more accurately control equipment operations. By implementing Advantech’s automated monitoring and control solution, steel factories can not only improve the manufacturing processes but can also allow users to add additional functions to the existing system so as to make sure the operation runs at high efficiency.

Case Study

Automated Predicitive Analytics For Steel/Metals Industry

Asset to be monitored: Wire Compactor that produces Steel RebarCustomer Faced The Following Challenges:Dependent upon machine uptime.Pressure cylinders within the compactor fail to control compression and speed causing problems in binding the coil.Equipment failure occurs in the final stage of production causing the entire line to stop, can you say bottleneck?Critical asset unequipped with sensors to produce data.